Buy and Hold May No Longer Be What Works Best for Investing

Buy and hold investing is a deeply entrenched mindset that most of today’s investors and investment managers have by default. It’s so widespread as a concept, that not many people are looking at it critically or asking if it still is working in today’s markets–or if another strategy would work better.

But this almost universally believed mantra of “you can’t time the market” doesn’t make a lot of sense anymore because of how investing tools have shifted.

The thing is, you can take your long-term investments to cash during most volatile times in the market to avoid losing money unnecessarily. And to do this you need to be able to identify market multi-year cycles (or work with someone who can do this for you). We offer such a service with our program

AMPT - Assisted Managed Portfolios by TRADEway.

Where the Buy and Hold Strategy Originated

Buying and holding through the market’s worst days can be devastating for your portfolio. So why does almost everyone do this?

The “buy and hold” recommendation was made famous by

John Bogle in his book

The Little Book of Common Sense Investing,

which was published in 2007. In it, Bogle argued that the fees that mutual fund managers charge rule out the extra returns they get from actively buying and selling in the market.

He showed you would profit more, and avoid lots of drama, by simply buying and holding index funds like the S&P and others.

But does this argument still hold up?

Where Bogle Got Buy and Hold Wrong

Bogle made the assumption that most people aren’t going to bother to learn the skills required to get in and out of the market effectively. And he’s right, most people won’t want to bother learning how to do that.

It takes a solid stock market education to time getting in and out of the market consistently. And making a mistake with regards to timing the stock market can really cost you.

But with the right training, tools, and expertise, timing larger market cycles is actually very doable.

In our program

AMPT, our Investment Advisor Representatives carefully monitor the market for breaks in market trends. And with our expertise (and the nimbleness that comes with not being in a mutual fund) we can get you out of the market more quickly, saving you from losing money unnecessarily.

We also have an option within

AMPT where you can request to have our investment advisory representatives do shorter-term trades using a portion of your money (we recommend no more than 20%). This can lead to a boost in your account that you can then turn around and re-invest.

Maybe the idea of trusting someone else to get your money out of the market and knowing when to put it back in makes you nervous. That’s understandable, given how much buying and holding is preached in our society.

Our long-term investing team are all registered investment advisors representatives. Our current roster manning the AMPT division include beloved stock trading Coaches

Geoffrey Nance,

Jenny Taylor,

Jared Russell, and

Ben Russell, and they are all well-versed in the market’s multi-year cycles.

Market Multi-Year Cycles

If you’re on board with the notion of someone getting in and out of the market with your long-term money, then the next thing to figure out would be when to get in and out.

How do we do that?

It turns out, markets have multi-year cycles. These cycles are one of the most important concepts to how we approach investing in our program

AMPT.

In short, you would look at longer term trends in the market. A key tenet of our

AMPT investing program is that longer term trends do not easily break. So when they do, that is a sign for us that we want to get defensive in our allocations.

We choose to not be in the market all the time, and sometimes that means we sit in cash while the technical charts settle into a new trend.

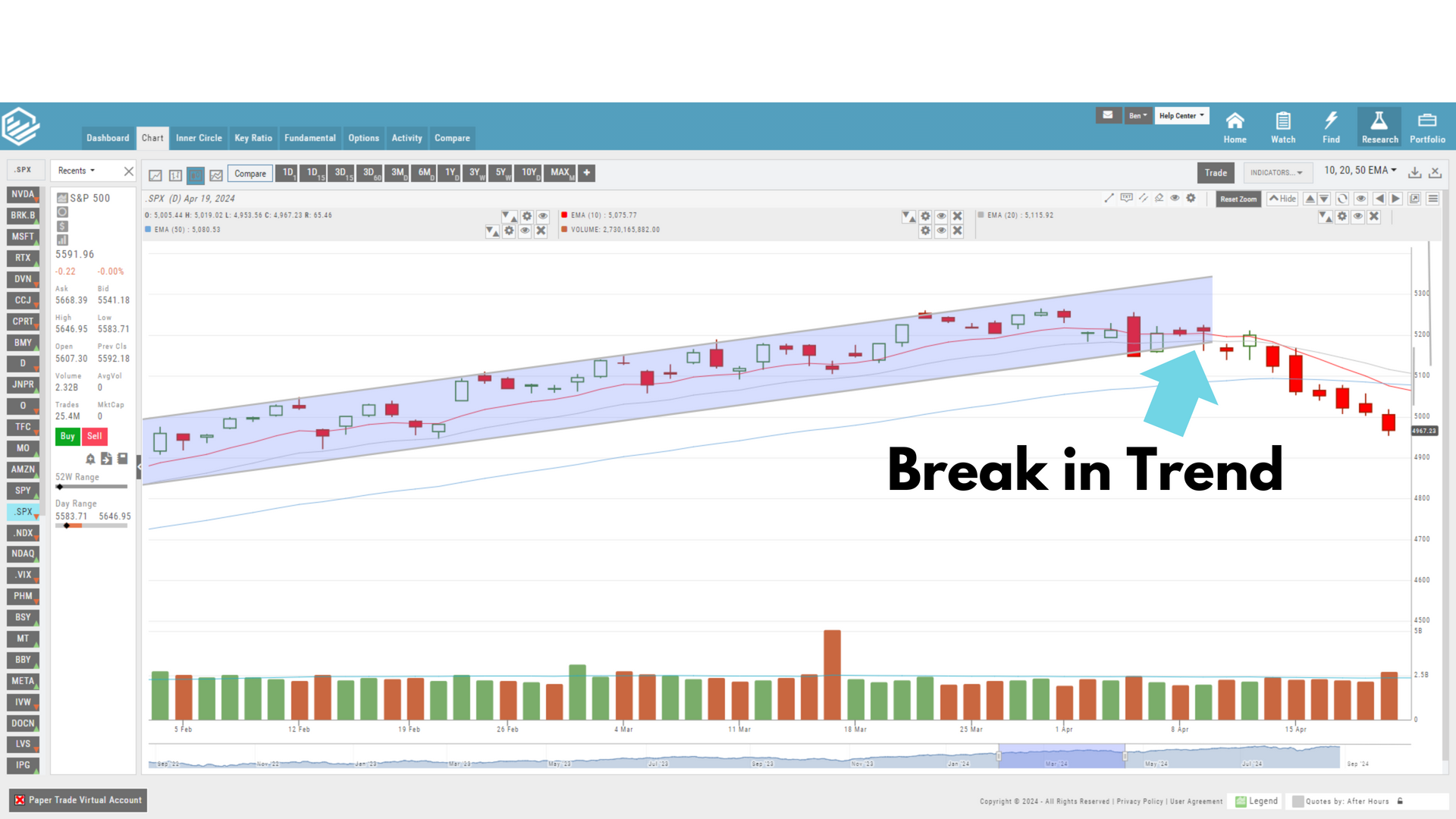

Image is from charting software Charts by TRADEway

The above chart of the SP-500 shows the normal bullish action in a trend we can easily identify, and then a break of trend. These breaks of trend are where TRADEway believes it makes sense to get defensive and get out of the market. Both watching multi-year cycles and looking for longer term breaks in a trend are two of our main tenets in our program AMPT.

Bear Markets, Bull Markets, and Squirrel Markets

Put simply, during a Bull Market, it’s generally a good time to be in the market; during a Bear Market, it’s not. And during a little something we here at TRADEway called a Squirrel Market (when the S&P is bouncing all around), it is definitely not a good time to be in.

Our

AMPT team keeps an eye on all of these kinds of long-term trends and communicates with our

AMPT clients often to keep them abreast of our current recommendations for your portfolio

(we believe in open and transparent conversations with our clients which is rare in this industry).

We also offer a range of risk profiles for long-term investing portfolios, from conservative to high-risk. High risk can yield higher returns. Our most conservative portfolio allocations are designed for those most concerned with keeping their hard-earned money intact. Our team can help you determine the best fit for your individual needs.

The times of greatest market volatility are when the market is “squirrely” and is breaking out of a trend. During these times, we watch the technical price action of the S&P closely to guide our decisions.

Aiming to Be in the Market on the Best Days and Out on the Worst Days

Our goal with AMPT is to minimize the risk to your long-term retirement funds. In the graph below, we see what would happen to a portfolio if you could magically miss the worst days in the market. While this kind of precision is not possible, more broad strokes of getting out of the market during a downturn are. Still, this graph can give you a sense of this principle in action:

Image credit: “How missing out on 25 days in the stock market over 45 years costs you dearly” by Michael Batnick

It’s impossible to do this perfectly–to only miss the worst days, and only be in on the best days. But we can get in and out of the market following broader, more general market trends, which is what we do in AMPT.

The Main Problem With Buy and Hold

It’s true that over decades and decades, traditional “buy and holders” will see a positive return. But by staying in the market through each and every downturn, they’re leaving money on the table unnecessarily–and lots of it. And a concern we hear with many new clients coming our way is that they do not have the TIME required to make it back if they happened to lose big on the down-side.

With a more agile long-term portfolio, you can avoid losing double-digit percentages during a downturn. And each time you successfully do this, your future returns are exponentially impacted by that extra money in the account. Wouldn’t you rather preserve your portfolio during a downturn and potentially have more in your portfolio to better take advantage of the next bull market? That is the goal.

If you’re ready to leave the “buy and hold” mentality in the past (where, let’s be honest, it should be), and if you’re wondering how much joining a program like

AMPT could impact the financial well-being of your family, book a call to learn more about our long-term investing portfolios.

Did you love this? Share it with your family & friends!